Managing multiple tax rates can be challenging, but Ever Accounting’s Import Taxes feature simplifies the process. This tool allows you to bulk upload tax details, including names, rates, and whether they are compound taxes. Follow this guide to import your tax details seamlessly.

What is the Import Taxes Feature?

The Import Taxes feature is designed to help businesses efficiently manage multiple tax rates. By uploading a preformatted CSV file, you can quickly add or update tax details in your database. This feature benefits businesses with varying tax rates across regions or products.

How to Access the Import Taxes Feature

- Navigate to the Tools Menu: From your WordPress Dashboard, go to Accounting > Tools. Here, you’ll find options for Import and Export.

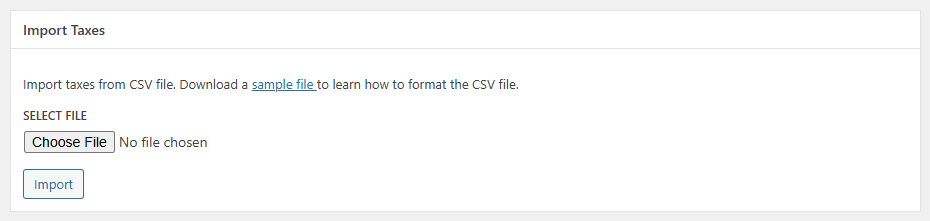

- Select The Import Tab: Click on the Import tab. Scroll down to the Import Taxes section.

- Download the Sample CSV File: A sample CSV file guides you through the required fields. Click the link under the Import Taxes section to download the file.

How to Prepare Your CSV File for Tax Import

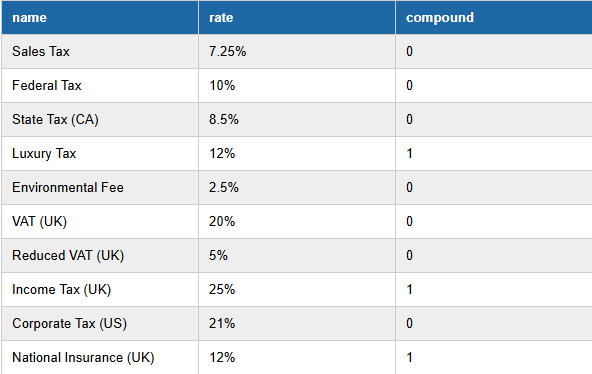

You’ll need a correctly formatted CSV file to import tax details successfully. Use the table below to understand the required fields:

| Field Name | Description | Example |

| Name* | The name of the tax. | VAT, GST, Sales Tax |

| Rate* | The tax rate as a percentage. | 5.00, 12.50 |

| Compound | Indicates whether the tax is compound. | Yes, No |

Step-by-Step Guide to Import Taxes

- Upload the CSV File: Go to the Import Taxes page. Click the Choose File button and select your prepared CSV file.

- Map Fields (if required): If prompted, verify that the fields in your CSV file match the plugin’s required fields. Adjust mappings as needed.

- Start the Import: Click the Import button to begin. The system will process your file and add the tax details to your database.

- Review Import Results: After the import, you’ll see a summary of the imported taxes. Check for errors or skipped entries, which will be highlighted for correction.

Download the Sample CSV File

To simplify the process, download the sample CSV file and use it as a template for your data.

Click here to download the sample CSV file for importing taxes.

Key Points to Note

Compound Taxes:

- Compound taxes are calculated on top of other taxes. For example:

- If Tax A is 10% and Tax B is 5% (compound), Tax B will be calculated on the subtotal, including Tax A.

Validation:

- Ensure your CSV file is correctly formatted.

- Invalid entries will be skipped, and you’ll be notified.

FAQs About Import Taxes in Ever Accounting

- Can I import taxes without using the compound field?

Yes, the compound field is optional. The tax will default to “No” for compound status if left blank. - Is there a limit to the number of taxes I can import at once?

No, there is no limit. Ever Accounting supports bulk uploads for any number of entries. - What happens if my CSV file contains errors?

The system will skip invalid entries and notify you of the errors. Correct them and re-upload the file. - Can I update existing taxes using the import feature?

Yes, if a tax with the same name already exists, its details will be updated. - What file format is supported for tax imports?

Only .csv files are supported.